The Internal Revenue Service’s Criminal Investigation division identified $1.8 billion in tax fraud in 2019, with a 91.2 percent conviction rate for all financial crimes, according to the division’s 100th annual report released Thursday, which also highlighted a continued focus on employment tax, cryptocurrency and cybercrime.

This year’s report, which marked the agency's 100th anniversary, continued a general downward trend of investigations and prosecutions for CI over the last few years. In a conference call with reporters, CI chief Don Fort attributed the trend to fewer special agents, as many retire and those who remain in service devote time to inheriting those cases and training new agents. Fort estimated that 130 to 150 agents retire every year, and that the time between onboarding new agents and completion of their first case averages two to three years.

The overall number of CI investigations initiated in 2019 was 2,485, down from 2,886 in 2018 and 3,019 in 2017. Meanwhile, $4.4 billion in proceeds from other (non-tax fraud) financial crimes were identified in 2019, 1,726 warrants were executed, and 1.24 petabytes of digital data were seized.

“We are in a hiring posture now,” Fort explained. “I’m very hopeful we’ve reached the bottom in terms of staffing. We end the year with 2,000 special agents, which puts us at 1970s levels.” Fort expects to onboard more in-depth special agents over the next year. “I’m really excited about that, and hopeful it’s not a one-time event. We have the support for a number of years of robust hiring, to get the numbers back up."

Overall, Fort characterized the past year, his third as chief, as “exciting times” as CI ramps up hiring, continues to take advantage of technology like data analytics, and collaborates with other agencies to combat newer threats related to cryptocurrency and cybercrime.

“We’ve had tremendous cases represented by every field office in every state; a lot of positive momentum there,” Fort said. “As we’ve been challenged in the manpower perspective for the last five to six years, we have used that time wisely. We’ve made investments in cyber, cyber investigations in tax and non-tax, working in data analytics with the Nationally Coordinated Investigations Unit [which became an official CI section this year]. The success we’ve seen there, we’ve invested wisely in the last few years. With the investment in those areas, we’re seeing the fruits of our labor.”

Another area of momentum for CI has been in employment tax enforcement, one of the few areas where the unit saw an upswing in investigations initiated (250), prosecution recommendations (104), informations/indictments (73), those sentenced (50) and the incarceration rate (84 percent), all an increase over 2018.

“In particular, employment tax, we made that a point of emphasis for CI and the IRS as a whole,” Fort said. “The time spent on employment tax has gone up considerably. There is a tremendous amount of noncompliance in that area. It’s a huge part of what funds the federal government. We’ve absolutely made that a point of emphasis. It’s the goal of field officers to work a balanced program area. All noncompliance tax threats in a particular area, as well as money laundering and bank secrecy threats. I can confirm employment tax will continue to be an area of emphasis for us.”

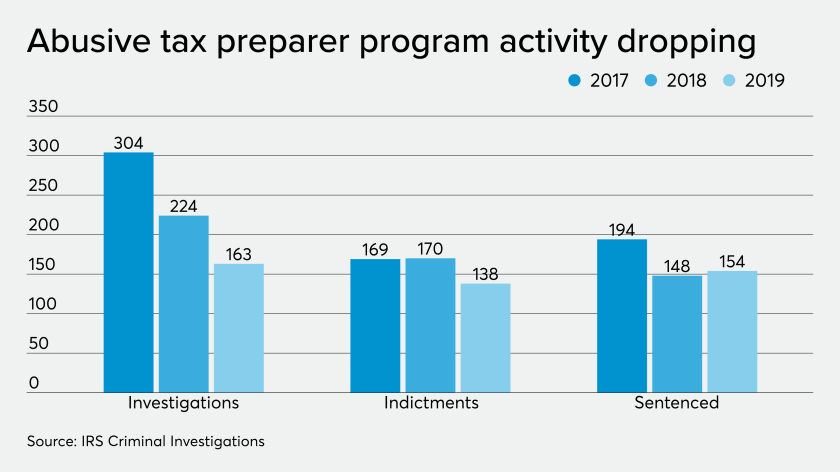

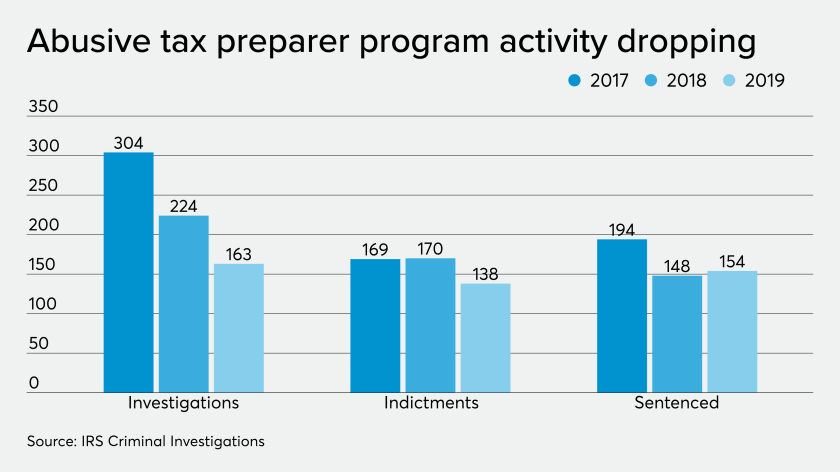

Abusive return preparer program enforcement also experienced some positive shifts in 2019. While the number of investigations in the category were down this year, at 163, the number of prosecution recommendations (203) and sentencings (154) were up slightly over last year, keeping the incarceration rate at a flat 78 percent.

In terms of collaboration with outside agencies, Fort identified the Joint Chiefs of Global Tax Enforcement, or J5, formed in 2018 among CI and its counterparts in four other countries to battle international tax evasion, as one recent success.

Other examples of interagency successes, though acknowledged by Fort to be more dated, were the shutdowns of darknet markets Silk Road and AlphaBay, in 2013 and 2017, respectively, “a great example of multi-agencies, under the Department of Justice, helping to solve crimes.”

“The most recent success in cryptocurrency was the Welcome to Video case, the child exploitation case,” Fort said, referring to what the DOJ called the “largest dark web child porn marketplace” when it took down the website in October. The use of bitcoin on the site led to CI’s involvement in tracking the cryptocurrency.

Fort anticipates that this kind of collaboration will continue in the years ahead.

“The next wave of crime, in front of our eyes, requires us to employ new ways of investigation in solving these crimes. The crimes are money- and greed-based, conducive to our work in following the money. We all have our own skills and capabilities. We have a lot of initiatives underway to partner with federal agencies and collaborate internationally.”

CI has also been partnering with academia to deepen its expertise in data analytics, working with universities and colleges that are utilizing the technology in innovative ways.

In the next year, Fort expects CI to help take down more dark web marketplaces and create more of a tax focus on cryptocurrency. Fort emphasized that CI currently has many open cases related to cryptocurrency and cybercrime that the agency hopes to make public by the end of this fiscal year.

Have a Criminal IRS Tax Problem?

Marini& Associates, P.A.

for a FREE Tax HELP Contact Us at:

Source:

accountingTODAY

No comments:

Post a Comment